A taxpayer is a person or organization (such as a company) subject to pay a tax. Modern taxpayers may have an identification number (TIN), a reference number issued by the LRA to citizens or firms.

A taxpayer is an individual or entity that is obligated to make payments to municipal or government taxation-agencies, in this case, Liberia Revenue Authority. Taxes can exist in the form of income taxes and/or property taxes imposed on owners of real property, along with many other forms. People may pay taxes when they pay for goods and services which are taxed.

The term “taxpayer” often refers to the workforce of a country which pays for government systems and projects through taxation. The taxpayers’ money becomes part of the public funds, which comprise all money spent or invested by government to satisfy individual or collective needs or to generate future benefits. For tax purposes, business entities are also taxpayers, making their revenues and expenditures subject to taxation.

A Taxpayer Identification Number is your primary source of Identification as a taxpayer. It is used to identify you with the Liberia Revenue Authority, and the Republic of Liberia as a whole.

It is a 9-digit number beginning with 5

Ex. 5********

According to Section 53 of the Liberia Revenue Code, every legal resident having a tax obligation within Liberia should have a TIN. It is given to every Taxpayer free of charge, and no taxpayer should have more than one TIN.

A tax clearance certificate is an instrument issued by the Liberia Revenue Authority (LRA) that certifies that a taxpayer has complied with all known tax requirements at the time of issuance.

Normal processing time for a complete and accurate tax clearance certificate application is 1 to 4 working days. For incomplete applications (missing information, missing supporting documentation and/or outstanding tax liabilities) processing may take up to 5 working days. If all documentation and tax obligation issues are not settled within these 5 business days, a new application is required.

Tax Clearance Certificate is absolutely free.

A Tax Clearance Certificate is required and useful when you want to:

There are six (6) kinds of Tax Clearances didvided into three (3) categories as follows:

What is a Personal Income Tax (PIT)?

A personal income tax is amount paid by an individual on a periodic basis from his/ her personal income.

What is the PIT table ?

The PIT table shows the different bands of income earners and their corresponding applicable marginal tax rate.

| Band | From | To | Tax Rate | |

|---|---|---|---|---|

| 1 | - | 70,000 | 0% | of Gross Taxable Income |

| 2 | 70,001 | 200,000 | 5% | of Excess over 70,000 |

| 3 | 200,001 | 800,000 | 6,500 + 15% | of Excess over 200,000 |

| 4 | 800,001 | Above | 96,500 + 25% | of Excess over 800,000 |

How is PIT calculated? The PIT is calculated on the annual gross income which includes all of your cash and non cash benefits . Non cash benefits include vehicles, housing, gasoline coupons, etc. Pursuant to section 202-C, the Law allows for an annual exemption of L$100,000 on the aggregate market value of all non-cash benefits .

What is meant by an annual gross taxable income?

An annual gross taxable income is the summation of all monthly gross income for the year.

What is the difference between a marginal tax rate and an effective tax rate?

The difference between a marginal tax rate and an effective rate is that a marginal tax rate is the tax rate of the taxpayer’s band which is applied on the excess amount of his/her tax band and the effective tax rate is the actual tax rate levied on the taxpayer and is derived by dividing tax amount by earning before tax deduction.

What is the tax rate for a taxpayer who annual gross income is below the exemption threshold? For any taxpayer whose annual gross income is below the exemption threshold his /her tax rate is ZERO. Meaning no tax payment is required.

Is the New PIT table also applicable to contractors?

No. The New PIT table like the old table is only applicable to employees of both public and private sectors. Contractors of both public and private sector will continue to pay the 10% flat rate.

For our quarterly payments in Liberia, the LRA uses the Presumptive Taxation Scheme for Businesses.

Presumptive taxation scheme (PTS) allows you to calculate your tax on an estimated income or profit.

The scheme can be used by all businesses in Liberia. The Quarterly Rate of 4% is applied to Small Tax Division, which are businesses having a total annual turnover of less than L$3,000,000 (three million Liberian Dollars) and the Quarterly Rate of 2% is applied to Medium & Large Tax Divisions, which are businesses having a total annual turnover of more than L$3,000,000 (three million Liberian Dollars) and more than L$30,000,000 (Thirty Million Liberian Dollars), respectively.

It is filed every Quarter, and the deadlines are as follows:

| Quarter | Duration | Deadline |

|---|---|---|

| Quarter 1 | January 1 - March 31 | April 15 |

| Quarter 2 | April 1 - June 30 | July 15 |

| Quarter 3 | July 1 - September 30 | October 15 |

| Quarter 4 | October 1 - December 31 | January 15 |

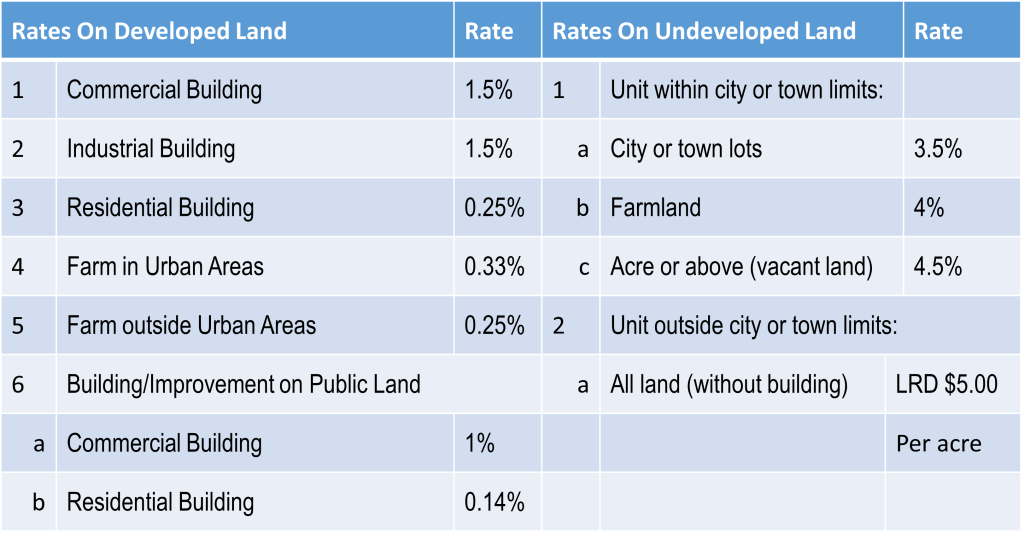

Real Property Tax is the tax paid ONCE a year on real property(ies) owned within the Republic of Liberia.

Real Property is immovable property. It is tangible fixed structure. Real Property include land and building and other fixed improvements to the land and/or building.

Real Property Tax is the product of the Real Property tax rate and the current market value of your property in keeping with Section 2001(b) of the Revenue Code of Liberia Act of 2000. (herein referred to as the LRC)

Market value is the capital sum which land, building or improvements might be expected to realize as at the date of assessment if offered for sale on such reasonable terms and conditions as a bona fide seller would require.

(In some lease agreements, owners of properties designate the lessee as responsible for the payment of the taxes, or the Lessee designates themselves as the responsible party, to ease negotiations or to facilitate bookkeeping.)

If you are renting a property, you don’t pay Real Property Tax. Instead, you pay a Withholding on Rental Income (10%).

After July 1, the payment is considered late and starts to accrue penalty and interest in keeping with Section 2002 of the LRC as follows:

“Penalty of 5% for each month elapsing after July 31st that the tax remains unpaid but not to exceed 25% Interest at the market rate as published by the Central Bank of Liberia”

Please note that with the Calculator you can estimate your yearly tax obligation using the fair market value of the property. However, the true value of your property may depend on other features of the property that you may not have factored in your estimation.

| Tax Type | Tax Rate | Due Dates |

|---|---|---|

| Personal Income Tax (PIT) | See PIT Table | Due by 10th day of suceeding month. |

| W/H on Wages/Salary | See PIT Table | Due by 10th day of suceeding month. |

| W/H on Rent | Resident 10% | Due by 10th day of suceeding month. |

| W/H on Rent | Non-Resident 15% | Due by 10th day of suceeding month. |

| W/H on Interests and Dividends | 15% | Due by 10th day of suceeding month. |

| Board & Management Fees | Resident 10% | Due by 10th day of suceeding month. |

| Board & Management Fees | Non-Resident 15% | Due by 10th day of suceeding month. |

| W/H on Payment for Services | 6% | Due by 10th day of suceeding month. |

| Contracts on Services Rendered | 10% | Due by 10th day of suceeding month. |

| Gambling | 20% | Due by 10th day of suceeding month. |

| Excise Tax | (See Excise Table) | Due by 21st day after month ends. |

| Goods & Services Tax | (see GST Table) | Due by 21st day after month ends. |

| Tax Type | Tax Rate | Due Dates |

|---|---|---|

| Iron Ore | 4.5% | Due dates per Mineral Development Agreement or Contract. |

| Gold | 3% | Due dates per Mineral Development Agreement or Contract. |

| Commercial Diamonds | 5% | Due dates per Mineral Development Agreement or Contract. |

| Tax Type | Applies to | Tax Rate | Due Date |

|---|---|---|---|

| Presumptive Tax (Advance Payment) | (Small Tax Division) | 4% | Due within 15 calendar days following the end of each quarter. |

| Advance Tax (Minimum Tax) | (Medium and Large Tax Divisions) | 2% | Due within 15 calendar days following the end of each quarter. |

| Tax Type | Tax Rate | Due Dates |

|---|---|---|

| Real Property Tax | (See Real Property Table) | January 1 to June 30 |

| Personal Income Tax | (See PIT Table) | Three months after end of calendar or fiscal year. |

| Corporate Income Tax (Regular) | 25% | Three months after end of calendar or fiscal year. |

| Mining | 30% | Three months after end of calendar or fiscal year. |

| Petroleum Project | 30% | Three months after end of calendar or fiscal year. |

| Rice Production | 15% | Three months after end of calendar or fiscal year. |

Excise Tax is a commodity based tax that is levied on excisable goods and services. It is levied on the production, importation of excisable goods and the provision of excisable services.

All excise taxes are calculated on the Cost + Insurance + Freight (CIF) of imported goods except for alcoholic beverages and tobacco product, and ex-factory price for local manufactured goods.

For alcoholic and non-alcoholic imported and locally manufactured beverages and tobacco product:

Liberia Revenue Authority

Typically replies within minutes

Thank you for contacting us. How can we help you today?

WhatsApp Us

🟢 Online | Privacy policy

WhatsApp us