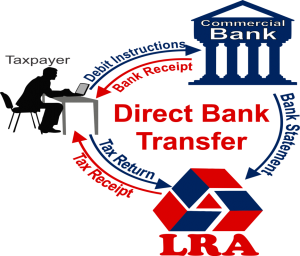

The payment of taxes through direct transfer from one account to another. That is from your account (taxpayer’s account) to Revenue Transitory Account at the Commercial Banks. (Account to Account Transfer)

This form of payment of taxes is a change from manual process of making payments by man- ager’s check and cash to the LRA and CBL. Direct Transfer Payment is an electronic payment mechanism which involves instructing a commercial bank to debit a taxpayer’s account and credit the Revenue Transitory Account with the tax amount.

All Taxpayers who have bank account(s) with any commercial bank in Liberia.

Complete a return for each payment and determine the taxes to be paid. Instruct your bank to debit your account for the amount determined using the payment instruction form.

Obtain Payment Confirmation Receipt from the Commercial Bank either physically or electron- ically (e-mail).

Submit a scanned copy your tax return(s) electronically or physically to LRA for returns pro- cessing and updating of your tax account.

LRA will subsequently update your tax account and issue you a valid receipt within 24 hours after the submission of a copy of your return form.

Liberia Revenue Authority

Typically replies within minutes

Thank you for contacting us. How can we help you today?

WhatsApp Us

🟢 Online | Privacy policy

WhatsApp us