To submit document electronically, send e-mail to: directtransfer@lra.gov.lr

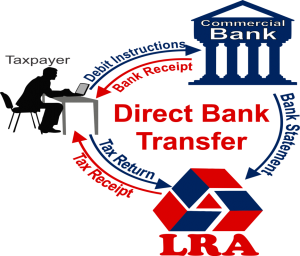

Direct Transfer

The payment of taxes through direct transfer from one account to another. That is from your account (taxpayer’s account) to Revenue Transitory Account at the Commercial Banks. (Account to Account Transfer)

This form of payment of taxes is a change from manual process of making payments by man- ager’s check and cash to the LRA and CBL. Direct Transfer Payment is an electronic payment mechanism which involves instructing a commercial bank to debit a taxpayer’s account and credit the Revenue Transitory Account with the tax amount.

All Taxpayers who have bank account(s) with any commercial bank in Liberia.

- Open an account with a local commercial bank, if you don’t already have

- If you have one, kindly update your bank account information to include your tax identification number (TIN).

What are the benefits of using this facility?

- Reduction of queuing time at LRA and CBL.

- Reduction in risks of fraud

- Taxpayers with appropriate infrastructure can issue payment instructions from their offices, the transport costs will be eliminated

- Reconciliations of accounts will be more efficient

- Enhanced information on bank statements for each tax payment.

- Taxpayers will know exactly when their account will be debited and can therefore ensure that their account is funded at that particular time.

How does it work?

Step#1:

- Obtain Tax Return Form from the LRA website or one of the LRA Taxpayer Service

- Obtain Transitory Account Payment Instruction Form from any Commercial Bank, LRA Tax- payer Service Center and/or on the LRA

Step #2:

Complete a return for each payment and determine the taxes to be paid. Instruct your bank to debit your account for the amount determined using the payment instruction form.

Step#3:

Obtain Payment Confirmation Receipt from the Commercial Bank either physically or electron- ically (e-mail).

Step#4:

Submit a scanned copy your tax return(s) electronically or physically to LRA for returns pro- cessing and updating of your tax account.

Step #5:

LRA will subsequently update your tax account and issue you a valid receipt within 24 hours after the submission of a copy of your return form.