In this article, I reflect on the 11-year journey of the Liberia Revenue Authority (LRA) since its formation in 2013. I provide a contextual background rooted in post-conflict governance reforms, particularly the EGAP and GEMAP initiatives. The piece highlights the Authority’s consistent growth in revenue collection, innovations in digital taxation, and strong leadership transitions. I argue that Liberia can achieve a billion-dollar domestic revenue milestone if the government invests adequately in the LRA’s operations and modernization. The article ends with a forward-looking perspective on reforms and an emphatic call for deeper public and government support.

Origins and Reform Context

In September 2013, former President Ellen Johnson Sirleaf signed into law an act passed by the National Legislature, establishing the Liberia Revenue Authority (LRA) as a semi-autonomous agency mandated to assess, collect, and account for domestic revenue. This landmark decision was no ordinary move. It was a bold restructuring in a post-war nation still healing from the scars of conflict. The reform drew its roots from earlier governance frameworks such as the Economic Governance and Action Plan (EGAP) and the Governance and Economic Management Assistance Program (GEMAP), which had laid the groundwork for post-war Liberia’s pursuit of transparency, accountability, and economic stability. In simple terms, the creation of the LRA was inspired by international best practices and fueled by the urgent need to overhaul a dysfunctional system that had long held the country back from keeping pace with regional and continental reforms.

Back then, the Ministry of Finance did it all: it made fiscal policies, spent the government’s money, and also collected the revenue. It was one body, one wallet, and one pen. This kind of centralized control created serious risks for corruption, mismanagement, and lack of transparency, it was thought. There were no clear separations between policy-making, revenue collection, and spending. That arrangement raised more questions about transparency and accountability than answers. It didn’t smell right. Reform was just unquestionably indispensable. That is why the change was inevitable. The creation of the LRA, therefore, meant separating revenue collection from policy and spending, introducing new accountability structures to promote transparency, efficiency, and integrity in public finance.

So, the Bureau of Revenue, which operated within the Ministry of Finance, was carved out and transformed into what we now know as the LRA. Meanwhile, the Ministry of Finance itself underwent a major streamlining, evolving into the Ministry of Finance and Development Planning after absorbing the former Bureau of the Budget and the Ministry of Planning and Economic Affairs. These changes were more than bureaucratic reshuffles. They were designed to promote transparency, enhance accountability, and infuse greater integrity into public financial management, all in support of Liberia’s development.

The Launch of the LRA

Fast-forward to Tuesday, July 1, 2014: the newly minted LRA, under Elfrieda Stewart Tamba, officially began its journey. Elfrieda and her “new baby” were now faced with a monumental task of assembling a competent workforce, recruited via international best practices, that would consistently meet annual national revenue targets while cultivating taxpayer trust and voluntary compliance. The journey had begun, and the stakes were high. It was taxing!

More than a decade has passed, and Tuesday, July 1, 2025, marked a historic milestone for the LRA. It clocked 11 years of consistent service, strategic reforms, and national impact. In 11 years, the LRA has transitioned from that small former Bureau of Revenue at the defunct Ministry of Finance into a powerful engine driving Liberia’s development. This journey, though challenging, has been defined by commitment, innovation, and a shared vision of national prosperity.

In these 11 years, the LRA has carried the weighty responsibility of financing the national budget year in and year out. That duty has rested not only on the shoulders of dedicated staff but also on the commitment of valued taxpayers, and support of international partners as well. Meeting the revenue targets assigned by the Legislature has never been easy, but it has always been the LRA’s mandate, its mission. Through it all, the Authority has seen transformation, progress, and the emergence of a stronger, more efficient tax administration.

In a special message marking the 10th anniversary of the LRA in 2024, Commissioner General James Dorbor Jallah extended heartfelt appreciation to the hardworking employees of the Authority and the taxpayers across the country for their unwavering patriotism. “Your contributions have played an instrumental role in the transformation of tax administration in Liberia, and we are proud to share the tremendous progress we have achieved together,” the CG noted. This shared effort between the LRA and the public has led to unprecedented growth in revenue and trust in the system.

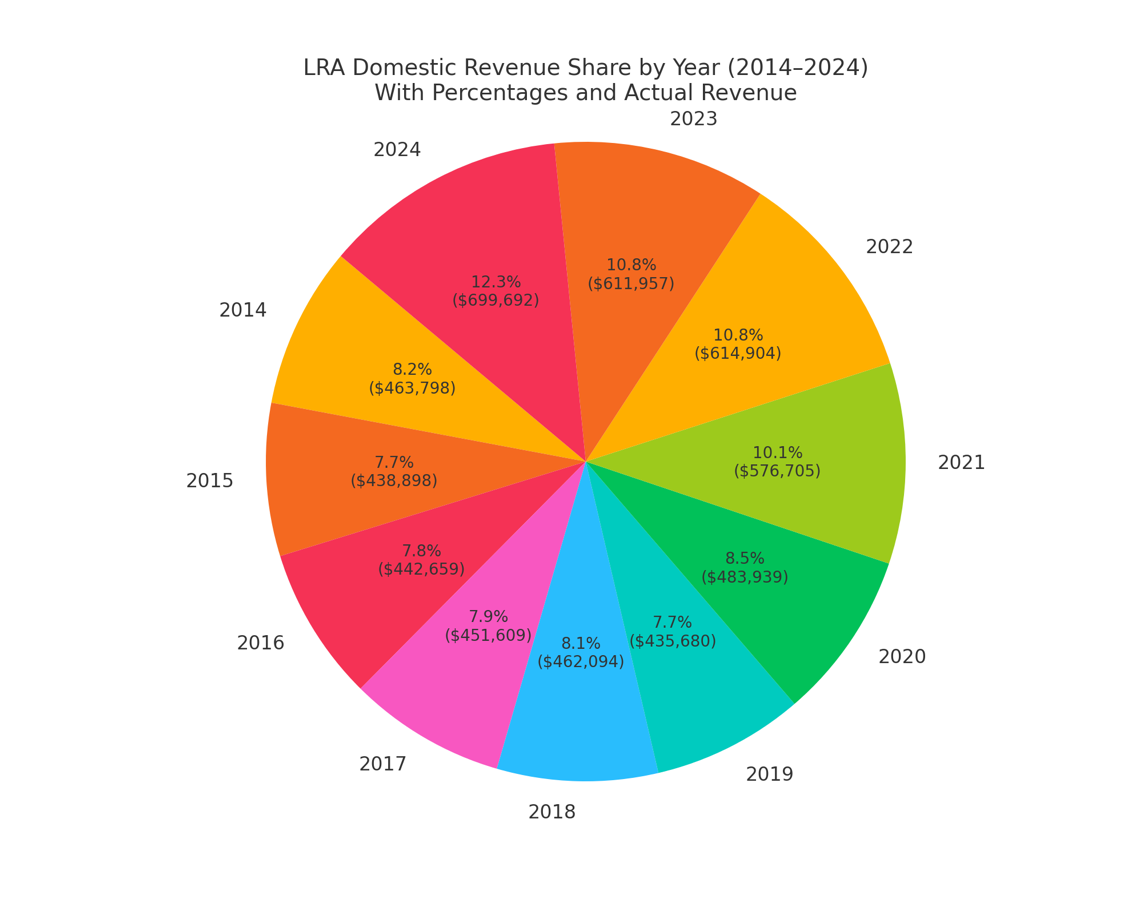

Tracking the Growth: From $463M to Nearly $700M

The LRA has been unbendingly progressive, and the numbers speak truth. From its first full fiscal year in 2014/2015, the LRA has steadily improved revenue collection. Starting with a domestic revenue intake of US$463.7 million, the Authority has now reached an impressive US$700 million in 2024. This marks a 51% growth in annual collection. Cumulatively, over the last 10 years (2025 excluded), the LRA has collected at least US$5.2 billion in domestic revenue. Obviously, these funds have directly supported the Government of Liberia’s development agenda.

This growth has been anything but random. It has been systematic, strategic, and responsive to both global trends and local realities. Yes, there were dips—particularly in 2015 and 2019 due to national economic pressures. But reforms and digitization initiatives since 2020 have reversed those declines, producing a surge of more than US$200 million in just four years. With this performance trend, talking about a billion-dollar domestic revenue year is no longer wishful thinking. It’s a realistic goal within reach if the LRA stays the course. “The US$1 billion target is achievable. We can reach it by closing revenue leakages both internally and externally—without depending on additional borrowing,” Commissioner General James Dorbor Jallah, challenged LRA staff at a general meeting in December 2025.

Transformation Through Visionary Leaderships

One of the key drivers of the LRA’s success has been visionary and consistent leadership. From the pioneering stewardship of Elfreda Stewart Tamba, to the digital transformation led by the late Thomas Doe Nah, and now the energetic leadership of James Dorbor Jallah, each administration has introduced critical reforms in revenue administration. They haven’t just led with integrity; they have been innovative and pragmatic.

Under CG Tamba, the LRA laid the groundwork for digital transformation with initiatives such as direct bank transfers and the paperless customs declaration. CG Nah, leveraging his IT background during the COVID-19 crisis, accelerated online tax systems—mobile tax payments, POS, and web payments—pushing revenue collection to a record peak.

CG Jallah has since built on those foundations. His leadership brought Starlink internet terminals to rural tax offices, connecting even the remotest areas to real-time digital systems. All rural ports and collectorate across the country are being automated for the first time in history. Platforms like Liberia Integrated Tax System (LITAS) and Automated system of customs data (ASYCUDA) World have automated assessments and payments, reducing physical human interactions, errors and delays, while boosting taxpayer confidence. The ongoing rollout of electronic fiscal devices (EFDs) among merchants will increase transparency, while integration with national systems (from passports to ECOWAS customs) are improving inter-agency collaboration and expanding the tax base. The reforms are not stopping – whether in the real estate tax category, the pending transition from GST to VAT or the visa upon arrival plan. These reforms keep coming because the LRA keeps innovating.

Local Reforms, Global Recognition

Transformation at the LRA is not just noticed in Liberia. It has won global recognition, and that points to the kind of leadership and innovation that drive things at the Authority. For example, in its 2025 Africa Country Policy and Institutional Assessment (CPIA) report, the World Bank hailed the LRA for the strides it continues to make in reforming the country’s tax administration. The global financial institution specifically pointed to significant efforts by the LRA to broaden the tax base, streamline revenue collection, and curb leakages, which are clear signs of progress that are now being noticed beyond Liberia’s borders.

According to the report, the introduction of the Value Added Tax (VAT) law in 2024, which takes effect in 2026, and the rollout of the Liberia Integrated Tax Administration System (LITAS) in 2022 are among the landmark reforms driving these improvements. These changes, the Bank noted, are helping the LRA extend its reach to more taxpayers across the country. The World Bank also recognized the LRA’s digital shift, highlighting innovations like online tax filing, electronic payment platforms, and simplified customs systems, as strong indicators of a revenue system undergoing meaningful modernization. Progress is visible and tangible.

Why the Government Must Invest More In LRA?

Despite this progress, however, the LRA still operates under financial constraints that hamper its full potential. Ironically, while it raises the millions, thinking about hitting the billions, for national development, it must wait in line for a portion of the budget it helps to generate. That is like the cook waiting last in line to eat the food they prepared.

This model is flawed and unsustainable, and there’s a need to follow growing global best practices. Revenue authorities in Rwanda, Kenya, Ghana, and Uganda have long outgrown this model. Their governments provide adequate and performance-based funding, allowing them to operate with more autonomy, attract talent, and invest in the kind of cutting-edge technology that drives compliance and results. These countries have significantly grown their domestic revenues while reducing dependence on foreign aid. Liberia must do the same. The LRA needs investment, and should be considered as a business. Its budget must be tied to performance, as Commissioner General Jallah has persistently advocated. If Liberia wants to collect US$1 billion in domestic revenue, it must first invest in the institution that will make it happen. And that is the LRA!

What Lies Ahead?

The LRA’s 11th anniversary is not just a moment for celebration but one for reflection and recommitment. We acknowledge that challenges remain. Some taxpayers still face difficulties navigating the new digital system. More awareness and tax education are needed, while the entire country needs to be adequately covered by staff. Many places and regions are underserved. Others continue to operate informally or resist compliance. These challenges can only be overcome through adequate funding, continued reforms, strategic outreach, and service improvement.

Looking ahead, the LRA is actively working on the Smart Revenue Collection System, a partnership with N-Soft, to further digitize revenue tracking and enhance efficiency in certain sectors. Plans are also in motion to expand the coverage of LITAS, integrate more digital payment channels, and roll out more EFDs across business sectors. The LRA remains firm in its belief that every dollar counts—because every dollar collected builds a road, lights a classroom, stocks a clinic, and pays a civil servant. The LRA will not relent. It will continue to push the boundaries of innovation, transparency, and service. That is why a motivated CG Jallah would say: “We are not just chasing numbers—we’re building a foundation for national self-reliance. Reaching a billion dollars in domestic revenue is not a dream; it is a deliberate target, and with the right investment, the right systems, and the right attitude, we will get there.”

Conclusion: A Stronger LRA, A Stronger Liberia

The story of the LRA is the story of Liberia’s march toward self-reliance. From a fragile post-war bureaucracy to a modern revenue institution, the LRA has grown into a national pillar. Eleven years later, it has come far—but it’s not stopping here. The billion-dollar year is not a dream. It’s the next step. With sustained leadership, stronger public cooperation, and greater government investment, Liberia can collect more revenue, more efficiently, and more fairly than ever before.

As its always said at the LRA: “Pay Tax, We All Enjoy.” The future of Liberia depends on it.

The Author, Danicius Kaihenneh Sengbeh is Manager for Communication, Media and Public Affairs, Liberia Revenue Authority. For inquiries or concern: +231777586531/ kaihenneh.sengbeh@lra.gov.lr /dakasen1978@yahoo.com

Liberia Revenue Authority

Typically replies within minutes

Thank you for contacting us. How can we help you today?

WhatsApp Us

🟢 Online | Privacy policy

WhatsApp us