We are Resolved to collect more Revenue

Domestic Resource Mobilization (DRM) in developing countries involves increasing public and private savings to finance social expenditure in education and health and investment in critical infrastructure to achieve inclusive growth and poverty reduction.

“Domestic resources are the largest untapped source of financing to fund national development plans” , while developing countries that have achieved and sustained high growth rates have typically done so through the mobilization of domestic resources .

For national development and budget financing, Liberia is currently confronted with stagnating growth in revenues and domestic debt, declining grants and donor transfers, rising external public debt and volatile net remittance flows. The overarching challenge of the DRM is therefore, to close the financing gap left by a declining Official development assistance (ODA)and slow down the rate of growth of the foreign loans to keep debt sustainable.

strategic approach to raising revenue

The strategic priorities are to expand the revenue base, minimize revenue loss, engender financial deepening in the money and capital markets, and exploit the nexus between DRM and overseas development assistance.

The headline risks inhibiting optimal tax collection in Liberia are a preponderance of informality, corruption, capital flight and low human and institutional capacity. The DRM seeks to mitigate against these risks in all the interventions proposed.

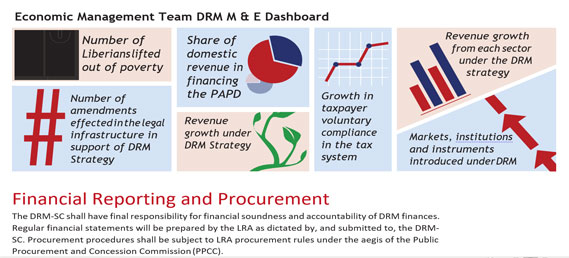

The main objectives of DRM Strategy are to finance the Pro-Poor Agenda for Development and Prosperity (PADP and inclusive growth as well as attain of the Sustainable Development Goals (SDGs)

The critical enablers are raising the tax effort, a conducive Legal Infrastructure for taxation, greater effectiveness and efficiency in tax system, macroeconomic stability (and Accountable and transparent public expenditure management to meet the needs of taxpayers), public confidence in tax system, comprehensive enterprise risk management, income growth while turning tax discount into tax premium sectors.

- Adoption and implementation of the Domestic Resource Mobilization (DRM) Strategy, FY 2018 – FY 2022 – Actual Revenue intake at end-FY 2017 stood US$ 407 Million, the DRM estimates additional revenue of US$ 203 Million on average annually or a sum of US$ 1,010 Million over 5 years, CONTIGENT UPON:

- Implementation of an electronic and mobile tax system with attendant housing infrastructure for tax administration – Component 1

- Implementation of projects in the sectors customized for revenue collection to turn tax discount into tax premium sectors – Component

- Introduce legislation to expand the institutions, markets and instruments in the financial sector to raise the savings rate and private access to Among others, float Diaspora Bonds (medium to long term) to provide a facility for Liberians abroad to participate in the development of Mother Liberia. Introduce President George Manneh Weah Treasury Certificates for small savers to support the Pro-Poor Agenda by providing short term liquidity to Government. Given the dismal history of public debt instrument issues, enough safeguards are envisaged for these issues to ensure returns and capital safety of subscribers’ funds –Component 2.

Highlights from the DRM

- Through appropriate legislation, significantly reduce tax exemptions and holidays which accounted for revenue loss of US$ 116 Million in 2015 and US$ 134 Million in As not all exemptions may be eliminated, DRM estimates US$ 78 Million annually from reduction.

- Establish a Precious Metals Marketing Corporation for buying and selling of all precious metals, create employment through value addition and organizing, equipping and providing extension services to the artisanal sector as well as a pass through a greater share of the international price to them in line with the Pro-Poor To withhold taxes from both buyers leading to substantial intake.

- Establish the Governance Structure (attached) involving senior beneficiaries supported by a DRM Secretariat at the Liberia Revenue Authority (LRA) – Component

- Engage Development Partners for DRM financing and establishment of a DRM Basket under the purview of the Governance Structure

- Implementation cost is estimated at US$ 79 Million: Component 1A & 1B @ US$ 8 Million, Component 2 @ US$ 4.2 Million and Component 3 @ US$ 4 Million